Venture Capital & Private Equity Industry Description

Venture capital and private equity are two closely related industries that play a significant role in the United States' economy. These industries provide crucial funding and support to startups, emerging companies, and established businesses, driving innovation, job creation, and economic growth. Venture capital (VC) refers to the financing provided to early-stage, high-potential companies with significant growth prospects. VC firms typically invest in startups and small businesses that have innovative ideas, disruptive technologies, or unique business models. These investments are often considered high-risk, high-reward, as many startups fail, but successful ones can generate substantial returns. Private equity (PE), on the other hand, involves investments in more mature companies that are not publicly traded. PE firms acquire a controlling or significant stake in these companies, aiming to improve their performance, increase their value, and eventually sell them for a profit. P...

Read More

4,015

COMPANIES

250 Billion

TOTAL VALUE

Related Industries

Avg Salary in Venture Capital & Private Equity

$146,228

AVG SALARY

List of Companies

| COMPANY NAME | INDUSTRY | LOCATION | REVENUE | EMPLOYEES | |

|---|---|---|---|---|---|

|

United States, California |

500 Million to 1 Billion |

51-200 |

|||

|

About Sequoia Capital Sequoia Capital, founded in 1972 by Don Valentine, stands as a monumental venture capital firm headquartered in Menlo Park, California. It has become synonymous with the success of numerous high-profile technology companies, playing a pivotal role in the early funding of giants such as Apple, Google, Oracle, PayPal, Stripe, YouTube, Instagram, Yahoo!, and WhatsApp. Sequoia Capital's influence spans across the United States, China, India, and Southeast Asia, showcasing its global footprint in the venture capital landscape. Did You Know? Sequoia Capital's initial investment in Apple was a mere $150,000 in 1978, which is considered one of the most lucrative investments in history. This early bet on Apple's potential underscores Sequoia's knack for identifying and nurturing groundbreaking technology companies. Sequoia Capital is not just about funding; it's about building lasting partnerships with entrepreneurs, guiding them from the seed stage of their startups to IPO and beyond. T... Read More |

|||||

|

United States, California |

250 Million to 500 Million |

51-200 |

|||

|

About Accel Accel Partners, founded in 1983, stands as a prominent American venture capital firm, with its headquarters nestled in Palo Alto, California. This firm is renowned for its investments in the technology sector, particularly in companies that are in their early and growth stages. Accel has made a name for itself by being one of the first investors in some of the most iconic companies of the digital age, including Facebook, Dropbox, Slack, and Spotify, among others. Accel operates on a global scale, with offices not only in the United States but also in London, Bangalore, and Beijing. This global presence allows Accel to support and invest in companies worldwide, making it a truly international player in the venture capital space. Did You Know? Accel was one of the early investors in Facebook, investing $12.7 million in 2005, a move that turned out to be extraordinarily prescient as Facebook grew to become one of the largest and most influential companies in the world. This investm... Read More |

|||||

|

United States, California |

500 Million to 1 Billion |

201-500 |

|||

|

About Andreessen Horowitz Andreessen Horowitz, also known as a16z, is a private American venture capital firm founded in 2009 by Marc Andreessen and Ben Horowitz. The firm is headquartered in Menlo Park, California, and is known for its focus on technology companies. Andreessen Horowitz invests in both early-stage startups and established growth companies across a wide range of technology sectors, including bioinformatics, consumer services, and enterprise software. Since its inception, Andreessen Horowitz has raised a series of funds totaling billions of dollars and has been involved in the funding of a number of high-profile technology companies, such as Facebook, Airbnb, Lyft, and GitHub. The firm is notable for its unique approach to venture capital, which includes a large staff of professionals to support portfolio companies with executive recruiting, market research, and regulatory affairs. Did You Know? Marc Andreessen, co-founder of Andreessen Horowitz, was also a co-author of Mosaic, the first w... Read More |

|||||

|

United States, California |

10 Million to 25 Million |

11-50 |

|||

|

About Kleiner Perkins Kleiner Perkins, officially known as Kleiner Perkins Caufield & Byers (KPCB) until 2019, is a venture capital firm headquartered in Menlo Park, California. Founded in 1972 by Eugene Kleiner, Tom Perkins, Frank J. Caufield, and Brook Byers, the firm has become one of the most recognized names in Silicon Valley, playing a pivotal role in the rise of the tech industry. Kleiner Perkins specializes in investments in incubation and early-stage companies, particularly in the technology and life sciences sectors. Over the decades, Kleiner Perkins has been instrumental in the growth of more than 850 companies, including tech giants such as Amazon, Google, and Twitter. The firm's approach to venture capital has often been characterized by a hands-on investment strategy, where it not only provides financial backing but also strategic, operational, and management advice. Did You Know? Kleiner Perkins was one of the first venture capital firms to invest in green technology companies, highlig... Read More |

|||||

|

United States, California |

10 Million to 25 Million |

51-200 |

|||

|

About Greylock Greylock Partners is a prominent American venture capital firm focused on early-stage investments in technology companies. Founded in 1965 by Bill Elfers and Dan Gregory, with Charlie Waite joining shortly after, Greylock has established itself as one of the pioneering firms in the venture capital industry. The firm's headquarters are in Menlo Park, California, with additional offices in San Francisco, New York, and Boston. Greylock Partners has played a crucial role in the development of the technology landscape by investing in over 350 companies, many of which have become household names. Notable investments include LinkedIn, Facebook, Airbnb, and Dropbox, showcasing the firm's knack for identifying and supporting high-potential startups. Did You Know? Greylock Partners was named after the Greylock Mansion in Wellesley Hills, Massachusetts, where the firm's first office was located. This mansion was not only a base for their operations but also a symbol of the firm's commitmen... Read More |

|||||

|

United States, California |

250 Million to 500 Million |

51-200 |

|||

|

About New Enterprise Associates New Enterprise Associates, commonly known as NEA, stands as one of the world's largest and most active venture capital firms. Founded in 1977, NEA has been at the forefront of the venture capital industry, playing a pivotal role in the growth and development of numerous companies across various sectors, including technology, healthcare, and consumer products. With its headquarters in Menlo Park, California, NEA has expanded its reach globally, operating additional offices in the United States, India, and China. This global presence not only underscores NEA's commitment to fostering innovation worldwide but also provides the firm with a unique vantage point to identify and invest in promising startups across different geographies. Over the years, NEA has been involved in over 230 company IPOs and more than 390 mergers and acquisitions, a testament to its successful investment strategy and the significant impact it has had on the global startup ecosystem. The firm manages approximat... Read More |

|||||

|

United States, California |

1 Million to 5 Million |

11-50 |

|||

|

About Bessemer Venture Partners Bessemer Venture Partners (BVP) is a global venture capital firm that has been fueling innovation and supporting entrepreneurs since its inception in 1911. Originally established by Henry Phipps, a co-founder of Carnegie Steel, BVP has a rich history that spans over a century, making it one of the oldest venture capital practices in the United States. The firm is headquartered in Redwood City, California, with additional offices in New York, San Francisco, Boston, Israel, and India. Bessemer Venture Partners is renowned for its investments in seed, startup, and growth-stage companies, particularly in the technology and healthcare sectors. Over the years, BVP has been an early investor in some of the most iconic companies of the digital age, including LinkedIn, Pinterest, Shopify, and Twitch. The firm manages more than $5 billion of venture capital invested in over 130 companies around the world. Did You Know? Bessemer Venture Partners operates with a unique approach to investing... Read More |

|||||

|

United States, California |

50 Million to 100 Million |

51-200 |

|||

|

About General Catalyst General Catalyst is a prominent American venture capital firm focused on early-stage and growth investments. Founded in 2000 by Joel Cutler, David Fialkow, and John Simon, the firm has its headquarters in Cambridge, Massachusetts, with additional offices in San Francisco, New York City, and Palo Alto. General Catalyst has made a significant impact on the tech industry by investing in and supporting a wide range of innovative companies across various sectors, including Airbnb, Stripe, Snap Inc., and Deliveroo. The firm operates with a unique approach to investing, emphasizing a strong partnership with entrepreneurs to help them build influential, enduring companies. General Catalyst has managed to raise over $5 billion in capital commitments across its funds since its inception. Did You Know? General Catalyst not only focuses on financial investments but also places a strong emphasis on building a community among its portfolio companies. They host an annual event called "CEO Summ... Read More |

|||||

|

United States, California |

100 Million to 250 Million |

11-50 |

|||

|

About Founders Fund Founders Fund is a San Francisco-based venture capital firm, known for its unique approach to investing and its notable emphasis on supporting ambitious projects that aim to transform major industries. Founded in 2005 by Peter Thiel, Ken Howery, and Luke Nosek, the firm stands out for its early investment in some of the most groundbreaking companies of the 21st century, including SpaceX, Facebook, and Palantir Technologies. The firm operates with a philosophy that centers around supporting entrepreneurs who propose unconventional solutions to significant problems. This approach has not only set Founders Fund apart in the venture capital community but has also contributed to its reputation as a catalyst for innovation. Did You Know? Founders Fund was one of the first institutional investors in SpaceX, Elon Musk's aerospace manufacturer and space transport services company, demonstrating its willingness to bet on high-risk, high-reward ventures. Additionally, the firm's name, "Fou... Read More |

|||||

|

United States, Massachusetts |

50 Million to 100 Million |

11-50 |

|||

|

About Battery Ventures Battery Ventures is a global, technology-focused investment firm with a long-standing history of fostering innovation and growth in the tech industry. Founded in 1983, the firm has its roots in Boston, Massachusetts, and has since expanded its presence with offices in San Francisco, California; Menlo Park, California; New York City, New York; and Herzliya, Israel. Battery Ventures operates with a mission to back and guide companies at all stages of growth, from seed and early to growth and buyout stages. Over the years, Battery Ventures has made a significant impact on the technology sector, investing in a wide range of industries including software, enterprise IT, online marketplaces, consumer tech, and industrial technology. The firm manages more than $9 billion in committed capital, emphasizing its substantial influence and capacity to drive innovation. Did You Know? - Battery Ventures has a unique approach to investment, often focusing on niche markets and complex technologie... Read More |

|||||

Segmentation by Revenue

Industry Overview

The banking and finance industry in the United States is a crucial sector that plays a significant role in the country's economy. It encompasses a wide range of financial institutions, including commercial banks, investment banks, credit unions, insurance companies, asset management firms, and other financial intermediaries. Commercial banks are the backbone of the banking industry, providing a variety of services to individuals, businesses, and government entities. They accept deposits, offer loans, facilitate payments, issue credit cards, and provide other financial products and services. Some of the largest commercial banks in the U.S. include JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup. Investment banks, on the other hand, primarily focus on capital markets activities such as underwriting securities, facilitating mergers and acquisitions, and providing advisory services to corporations, governments, and institutional investors. These banks often work closely wi...

Read More

FAQs

1

What are the top 3 Venture Capital & Private Equity companies in the United States?

The top Venture Capital & Private Equity companies in the US are Sequoia Capital, Accel and Andreessen Horowitz. To view a full list of companies in this industry, please sign in to CIENCE GO Data.

2

How are these Venture Capital & Private Equity companies ranked in the US?

The companies are ranked based on factors such as revenue, workforce (employee count), and regional location.

3

How many Venture Capital & Private Equity companies are headquartered in the United States?

There are approximately 4065 of Venture Capital & Private Equity companies in the US according to the latest CIENCE data.

4

What is the economic impact of the Venture Capital & Private Equity in the US?

The median revenue for Venture Capital & Private Equity companies in the US is 2500000.

5

What is the average revenue of Venture Capital & Private Equity companies in the US?

The average revenue for Venture Capital & Private Equity companies is 62171833.

6

How can I find job opportunities in the Venture Capital & Private Equity in the US?

You can find job opportunities in the Venture Capital & Private Equity through online job portals, company websites, and industry-specific job fairs. Each company listed in the CIENCE database includes known company phone numbers and website information.

7

Where are Venture Capital & Private Equity companies located?

The Venture Capital & Private Equity companies are located across United States.

FAQs

The top Venture Capital & Private Equity companies in the US are Sequoia Capital, Accel and Andreessen Horowitz. To view a full list of companies in this industry, please sign in to CIENCE GO Data.

The companies are ranked based on factors such as revenue, workforce (employee count), and regional location.

There are approximately 4065 of Venture Capital & Private Equity companies in the US according to the latest CIENCE data.

The median revenue for Venture Capital & Private Equity companies in the US is 2500000.

The average revenue for Venture Capital & Private Equity companies is 62171833.

You can find job opportunities in the Venture Capital & Private Equity through online job portals, company websites, and industry-specific job fairs. Each company listed in the CIENCE database includes known company phone numbers and website information.

The Venture Capital & Private Equity companies are located across United States.

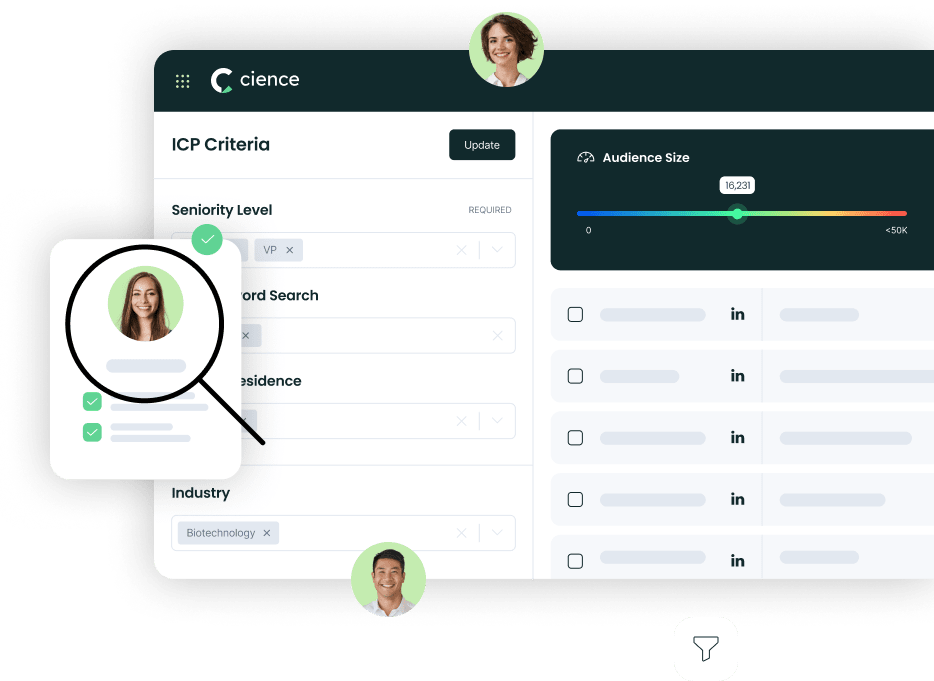

Premium Sales Data for Prospecting

-

Sales data across over 200M records

-

Up-to-date records (less decayed data)

-

Accurate Email Lists (real-world tested)

-

Powerful search engine and intuitive interface